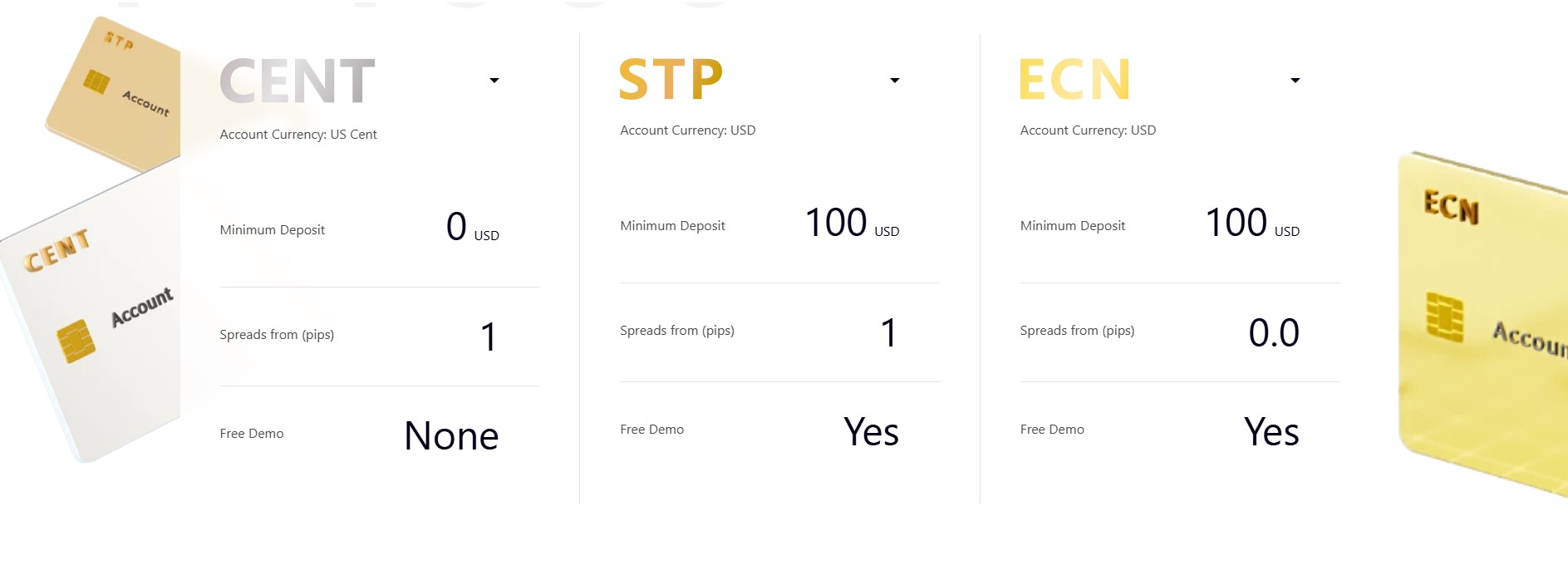

| Type | Min Deposit | Base Currency | Spread From |

| CENT | $0 | USC | 1.0 pips |

| STP | $100 | USD | 1.0 pips |

| ECN | $100 | USD | 0.0 pips |

| Professional | Custom | Multiple | Variable |

The platform supports over 20 distinct funding methods across 150+ currencies. Bank wire transfers process within 1-3 business days with fee reimbursement above $1,000. Credit and debit card deposits provide instant funding access. E-wallet solutions enable rapid account capitalization.

Currency conversion policies affect deposit processing across different account types. Cross-currency deposits incur market-based conversion rates. The platform supports direct deposits in USD and USC base currencies. Multiple currency accounts require separate verification processes

| Transaction Type | Fee Rate | Processing Time |

| Same Currency | 0% | Immediate |

| Major Pairs | 0.1% | Same Day |

| Minor Pairs | 0.2% | Same Day |

| Exotic Pairs | 0.3% | Next Day |

Each funding method maintains specific processing timeframes for account crediting. Bank wire transfers complete within 1-3 business days after confirmation. Card payments reflect instantly in trading accounts. E-wallet transfers process within 24 hours of initiation. Payment gateway processing varies by provider and region.

| Level | Documents | Validity Period | Deposit Limit |

| Basic | ID Only | 12 months | Up to $1,000 |

| Standard | ID + Address | 6 months | Up to $10,000 |

| Enhanced | Full KYC | 3 months | Unlimited |

| Corporate | Company Docs | 12 months | Custom |

Minimum deposit requirements affect bonus program eligibility. The $100 threshold activates the standard 20% deposit bonus. Higher deposits unlock increased bonus percentages up to $2,000 maximum. Bonus credits require specific trading volume completion for withdrawal.

Deposits exceeding $1,000 through wire transfer qualify for fee reimbursement. StarzPay users receive compensation for significant exchange rate differences above $1,000. Documentation requirements apply for fee reimbursement claims. Processing times for reimbursements average 3-5 business days.

Doo Prime maintains specific deposit protocols across different jurisdictions. Service restrictions apply to certain regions including Afghanistan, Canada, and Hong Kong. Regional payment methods vary based on local regulations. Currency controls affect deposit processing in specific territories. Each jurisdiction requires unique compliance documentation.

| Method | Daily Limit | Monthly Limit | Annual Limit |

| Bank Wire | $100,000 | $500,000 | Unlimited |

| Cards | $10,000 | $50,000 | $500,000 |

| E-wallets | $5,000 | $25,000 | $250,000 |

| Payment Gates | $20,000 | $100,000 | $1,000,000 |

Initial deposits influence trading condition assignments. Larger deposits access reduced spread structures. Volume-based deposit requirements affect VPS service eligibility. Account type transitions require minimum balance maintenance. Trading Central access activates with qualified deposits.

| Deposit Range | Spread Reduction | Commission Rate |

| $100-$999 | Standard | Standard |

| $1,000-$4,999 | -0.1 pips | -10% |

| $5,000-$9,999 | -0.2 pips | -20% |

| $10,000+ | -0.3 pips | -30% |

Institutional accounts access specialized deposit conditions based on volume commitments. Corporate wire transfers utilize dedicated banking channels. Multi-account management systems enable centralized fund allocation. Custom currency pairs accommodate specific trading requirements.

| Service | Standard | Premium | Enterprise |

| Processing Time | Same Day | Priority | Immediate |

| Fee Structure | Standard | Reduced | Custom |

| Support Level | Dedicated | VIP | Executive |

| Currency Options | Major Pairs | All Pairs | Custom Pairs |

SSL encryption protects all deposit transactions across platforms. Two-factor authentication requirements safeguard large transfers. IP restriction options limit deposit source locations. Real-time monitoring systems flag suspicious deposit patterns.

Deposit bonuses credit immediately for card and e-wallet deposits, while wire transfers activate upon clearing, typically within 1-3 business days.

Bank statements, transfer confirmations, or payment gateway receipts must match the registered account name and verify deposit origin.

Single trading accounts accept deposits in one base currency. Multiple currency deposits require separate account registration or conversion to the base currency.

Disclaimer: Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

This website serves as an overview and information platform about the broker. All articles and content on this site are written by industry experts and are intended to provide information and opinions. Please note that this site is not affiliated with the official website of any broker that is reviewed or mentioned. The contents of this website should not be considered as financial advice.